Retail Sales Growth in 2017 Can Have a Powerful Impact On Property Values

by Michal Ben-Moshe, Senior Marketing Director

Posted on February 22, 2017 at 9:00 AM

SHARE POST

Confident Consumers Trigger Retail Sales Growth

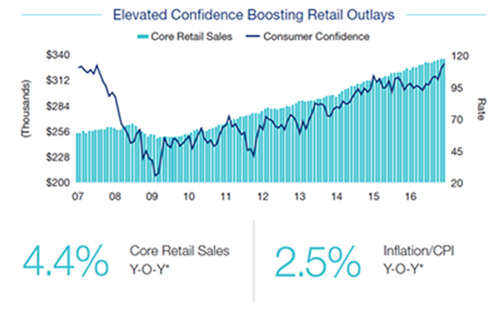

According to the U.S. Census Bureau and the National Retail Federation consumers followed up robust holiday spending with equally impressive activity in January as core retail sales vaulted 4.4 percent over the past year. Consumer confidence remains near the highest levels of the past decade, reflecting heightened expectations for economic conditions and sentiment. This positive outlook, together with steady job growth and wage gains, has boosted consumption.

Sales surged 8.5 percent at health and personal care stores over the past year. Boosted by a deal with Target to acquire their in-store pharmacies, CVS added 1,900 locations in 2016. E-commerce has grown as well which represents 12 percent of retail sales. The two largest retailers are pursuing different strategies to drive revenue growth. Wal-Mart recently acquired Moosejaw, which follows the 2016 purchase of Jets.com, in order to drive more traffic to its web portals. Meanwhile, Amazon is expanding third-party offerings on its platform. A recent announcement highlighted a 50 percent increase in third-party sales over the holidays. Significant growth in e-commerce is driving demand for industrial spaces, prompting a 50-basis-point decline in vacancy to 5.7 percent in 2016.

Vacancy Decline, Rent growth and Cap Rates changes

Rising inflation, driven by strong gains in oil prices, pushed CPI up 2.5 percent over the past year. The ascending inflation bolsters the case for the Federal Reserve to move towards normalizing interest rates over the coming year. After meeting in December, the Federal Reserve announced their intention to hike interest rates three times in 2017.

"While Rising interest rates raise concerns about the potential impact on commercial real estate property values, the rent growth offset the potential impact of rising cap rates", says Roee Ben-Moshe, a co-founder in the Ben-Moshe Brothers Group of Marcus & Millichap.

"Nationwide vacancy in retail properties declined 50 basis points over the past year to 5.5 percent, matching the previous cycle lows. Asking rents rose 3.3 percent over that time frame. The 2017 forecast shows vacancy falling an additional 40 basis points to 5.1 percent and solid growth in rental rates. This point has important implications for commercial real estate property values and investment performance", he explains.

"While the prospects for U.S. commercial real estate market still look bright, it is important to recognize that it is strongly affected by economic and financial market volatility."

© The content provided in this article is owned by The Ben-Moshe Brothers of Marcus & Millichap and is subject to Copyright Laws.

For Latest Updates