Mixed Signals for Real Estate Investors as the Fed Rate Increased

by Michal Ben-Moshe, Senior Marketing Director

Posted on January 3, 2017 at 15:00 PM

SHARE POST

The Federal Reserve Raised Its Overnight Rate

The U.S. Federal Reserve voted to raise interest rates for the first time in 2017 at its two-day Federal Open Market Committee (FOMC) March meeting, which concluded on Wednesday. The target will be raised by 25 basis points to a range from 0.50 percent to 0.75 percent. This decision reiterates the Fed's confidence about the robustness of the economy and its resilience.

Janet Yellen, chair of the Fed’s board of governors, said the economy is on a healthy footing as unemployment is falling. The current 4.6 percent unemployment rate is effectively full employment. The tight labor market will support wage growth and that will raise inflationary pressure. As a result she expects the Fed to remain highly vigilant in the coming year.

Rising Rates Widen Gap in Expectations

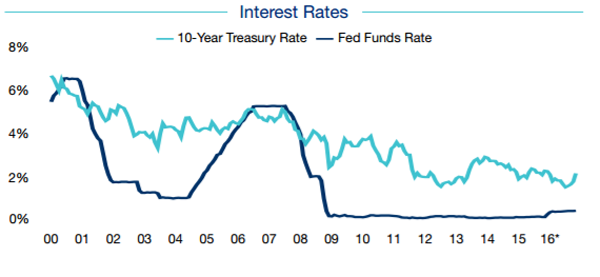

Despite the Fed’s initial hike in December 2015, U.S. interest rates remain quite low for the past seven years. While the Fed is expected to continue raising interest rates in the coming year, the rising rates widen gap in expectations and raise concerns about the potential impact on U.S. commercial real estate property values. Specifically, investors worry about the impact of rising interest rates on property cap rates. Real estate investors fear that rising interest rates will weaken property values and total returns.

Interest Rate and Cap Rates Relationship

However, historical data show that higher interest rates have not necessarily weaken the commercial real estate total returns. In fact, according to the National Council of Real Estate Investment Fiduciaries’ (NCREIF) database, appraisal capitalization rates historically have often remained resistant to the pressures of rising interest rates. In addition the NCREIF suggests that the relationship between cap rates and interest rates is more complicated and influenced by a wider network of variables, including real estate fundamentals, unemployment rate, 10-year Treasury, investor risk appetite and more. Thus, the impact of rising interest rates on real estate performance is difficult to predict.

Commercial Real Estate outlook 2017

The outlook for real estate in a rising rate environment depends on a variety of factors indeed. However, the timing of interest rate changes matters and the increase may cause a mismatch between buyer and seller expectations that could reduce transaction volume in the next few years. As a result, interest rates will remain a significant factor in the commercial real estate market that could force asset repricing.

© The content provided in this article is owned by The Ben-Moshe Brothers of Marcus & Millichap and is subject to Copyright Laws.

For Latest Updates