September Retail Sales Outperform as Foot Traffic Remains Elevated

by Michal Ben-Moshe, Senior Marketing Director

Posted on October 21, 2021 at 03:44 PM

SHARE POST

Retail Sales

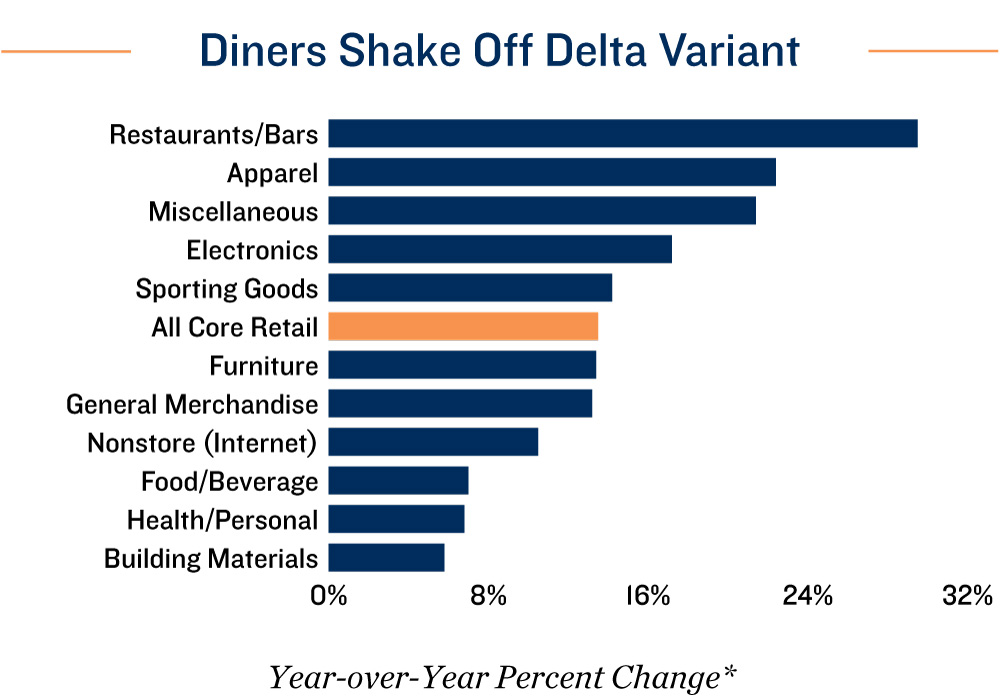

Consumer spending sturdy last month. Unfazed by the end of federal unemployment benefits and other dissipating stimulus, core retail sales increased 0.7 percent in September and 13.5 percent from the same period last year. Although inflation, which climbed 0.4 percent last month, was a contributing factor to the rise, the overall spending picture remained brighter than anticipated. Lingering back-to-school shopping and wider office openings contributed to the gains as apparel and gas station spending advanced 1.1 percent and 1.8 percent, respectively. Only two of the 13 major retail sectors recorded declines last month: electronics and appliance stores and health stores.

Strong sales support retail properties. Consumer spending supported brick-and-mortar retailers through the worst of the health crisis. Overall vacancy peaked in the first quarter of this year and has since trended lower while rents continue to rise. While more retailers will undoubtedly eventually shutter because of the health crisis, those closures will, in turn, funnel shoppers into the remaining stores that survive, further strengthening the businesses that remain. Year over year, total foot traffic is up 16 percent. Grocery stores have registered nearly equal gains in annual sales growth (7.5 percent) and visits (8.3 percent).

Variants have minimal impact on dining out. Receipts at eating and drinking places increased 29.5 percent year over year, the second-highest annual rise after gasoline stations. Visits to dining establishments rose 29 percent during the same period, matching the increase in sales. On a monthly basis, spending at restaurants and bars ticked up 0.3 percent, indicating diners were undeterred by the delta variant that sent cases rising across much of the U.S. in recent weeks. Additionally, vaccine mandates in some of the nation’s largest cities, including New York, Los Angeles and San Francisco do not seem to have kept diners away. Foot traffic trends in both California and New York remained relatively aligned with the national average last month.

Supply chain issues threaten holiday sales. As global trade reopens unevenly, the carefully orchestrated supply lines that existed prior to the pandemic are having trouble returning to previous efficiency. Approximately 500,000 containers are sitting on ships off the Los Angeles coast, and smaller, but significant backups are present in Savannah and New York. Unless unloading and transportation hasten in the coming months, some products may fail to reach store shelves before the holiday season.

Vaccine mandates cloud short-term outlook. Over the past several weeks an assortment of vaccine requirements, ranging from public to private and local to federal, have been enacted across the country. A small percentage of workers are opting to leave their positions rather than comply with these requirements, which has the potential to create turnover at more than a million jobs. The time it may take for companies to refill these spots could create a hiccup in the employment market, possibly hamstringing retail spending temporarily.

13.5% Gain in Core Retail Sales Since September 2020

16.3% Increase in Visits From September 2020

*Through September Sources: Marcus & Millichap Research Services; CoStar Group, Inc; Placer.ai; U.S. Census Bureau

For Latest Updates